The stock market has long been a way to make additional income, with some investors making significant gains on their investments. However, stocks tend to be volatile, especially in today’s economic climate.

Keel Magazine

Compound growth is an often reliable and secure way of expanding your wealth, by making an investment where the return you get grows and grows with each payout.

Eastport Financial held our annual turkey drive again this year, handing out turkey dinners to families so that they can celebrate Christmas at home. Another amazing event, and the drive was full of Christmas cheer spread out over two days. This year, we served the Halifax, Dartmouth, Bridgewater, and Lewisporte, Newfoundland areas.

Eastport Financial held our annual turkey drive again this year, handing out turkey dinners to families so that they can celebrate Christmas at home. Another amazing event, and the drive was full of Christmas cheer spread out over two days. This year, we served the Halifax, Dartmouth, Bridgewater, and Lewisporte, Newfoundland areas.

If you and your family are running a business or have significant investments, and you’re looking for a way to organize, protect, and streamline your family interests, then one of the better options is a Family Limited Partnership, or ‘FLP’ for short.

When it comes to investments, there’s no doubt it’s important to look at the return on investment, but when you’re considering the overall investment or enterprise, you need to think beyond that.

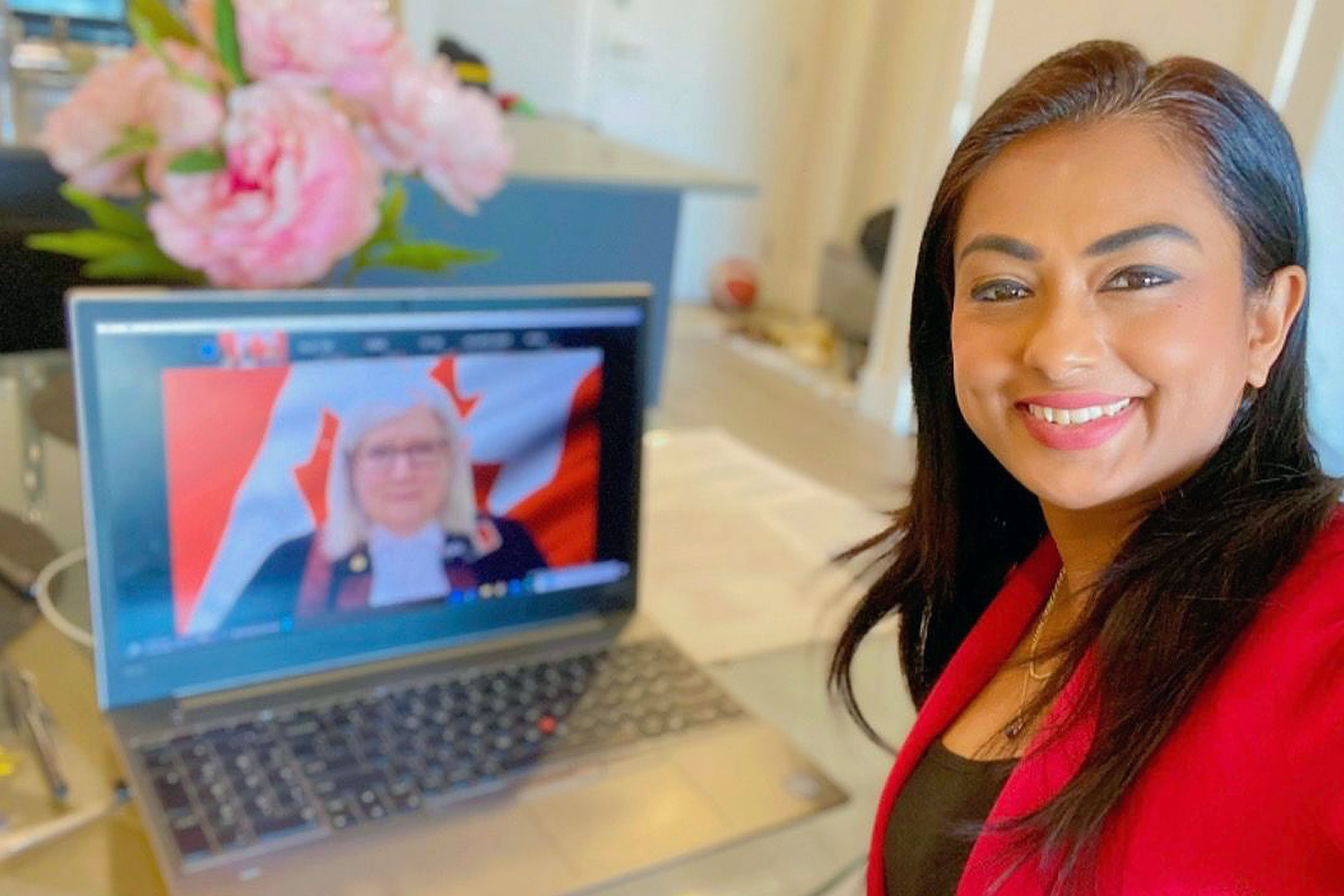

Shami moved to Halifax from Sri Lanka and she loves working at Eastport. Often the first point of contact with our clients, Shami makes people feel welcome while serving as Executive Assistant to Jonathan.

In this Video Quarterly Report, Matthew dives into Benchmarking and why it is important for an investment portfolio. He also provides an economic update with a discussion around a Bar chart of the 5-year yield from 1990-2011 vs 2011 to present.

Annuities can form a great source of income, especially for those looking for regular and structured retirement income. However, just because it is considered widely as a form of retirement income does not necessarily mean annuity payments are not subject to tax.

Equities in the U.S., Canada, and globally began the quarter on a positive note but faded in August and September, resulting in negative returns. However, year-to-date, equity markets remain in positive territory. Bond markets saw U.S. and Canadian yields rise due to credit rating downgrades and inflation concerns. Both presenting cheap buying opportunities for the long-term investor.

If you are seeking a tax-efficient option for your non-registered investments, Corporate Class Mutual Funds might just be a gem of an investment for you. Those of you that are seeking to actively reduce your tax burden are likely already investing heavily in Registered Retirement Saving Plans (RRSPs) and Tax-Free Saving Accounts (TFSAs). However, these accounts have limitations and depending on your income level may only be able to shield a fraction of your income from taxes.

Real Estate Investment Trusts, or ‘REITs’ for short, are a great way for investors to expand their investment portfolio and include real estate, without having to own, manage, or finance any actual real estate property.

However, like any other investment, it pays to do your research and you should be aware of the dynamics of your investment. To that end, we will be discussing REITs in detail today, including what factors to look at depending on the type of REIT you’re investing in.

We’ll also discuss the benefits of REITs and some other key considerations you should keep in mind before you decide to invest.

As a Canadian business owner, or as the holder of shares in a company, if you’re looking for an effective strategy for tax and succession management, then an estate freeze is one option you can exercise.

Through an estate freeze, you can limit income tax on future capital gains, reduce probate fees, and pass control to the next generation of your family in a tax-efficient manner.

Today we’ll be discussing what an estate freeze exactly is, how it works, its benefits, and whether you should consider an estate freeze for your assets.

After battling Covid19, the world today is faced with a new type of threat - an all-out inflation pandemic! Every day, we hear news of prices soaring for even basic commodities, such as food and clothing, and many families struggling to make ends meet. Almost everything today is more expensive than it once was and that is due in part to inflation.

After battling Covid19, the world today is faced with a new type of threat - an all-out inflation pandemic! Every day, we hear news of prices soaring for even basic commodities, such as food and clothing, and many families struggling to make ends meet. Almost everything today is more expensive than it once was and that is due in part to inflation.

Canada has a graduated or progressive tax system whereby, the more money you make the more you pay in taxes. This is why Canadian investors and high-net-worth individuals have to be extremely careful in terms of how they invest and what they invest in. The tax repercussions of their investment decisions can easily result in them paying out most of their gains in taxes with little to no financial reward.

Q2 was another strong quarter for investors with positive equity market returns and stable bond yields. The U.S., Canadian, and global equities closed the quarter and first half of 2023 positively, with technology being the leading sector.